we came across this article in the los angeles times. ya know this is all microsofts fault too. shoddy management, allowing crappy third party management companies to ruin and make a mockery of the msn brand name is all to blame. its not like this happened over night, oh no this has been going on for years and microsoft chose to do nothing. its all part of microsofts corporate culture that says that they know more than and whats best for their customers. in other words microsofts attitude is that they know whats best and the rest of us should just shut up and do what microsoft says to do. microsoft is getting just what they deserve.

we came across this article in the los angeles times. ya know this is all microsofts fault too. shoddy management, allowing crappy third party management companies to ruin and make a mockery of the msn brand name is all to blame. its not like this happened over night, oh no this has been going on for years and microsoft chose to do nothing. its all part of microsofts corporate culture that says that they know more than and whats best for their customers. in other words microsofts attitude is that they know whats best and the rest of us should just shut up and do what microsoft says to do. microsoft is getting just what they deserve.By Sallie Hofmeister, Times Staff Writer

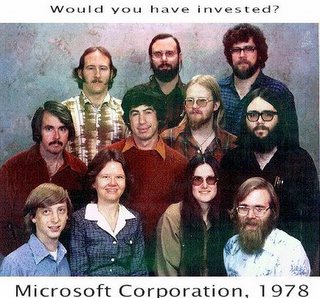

Just five years ago, Microsoft Corp. was considered the Big Bad Wolf of the media business.

Armed with a stockpile of cash and the Windows operating system that dominates office computing, Bill Gates' company was expected to huff and puff its way into America's living rooms as well, with video game consoles, home networking systems and TV set-top boxes.

But today, there's a different wolf at the door. Although Microsoft is still flush with $40 billion in cash, it is Google Inc. that the media industry fears most. So intense is Google-fueled paranoia, in fact, that industry watchers believe the Internet search giant could drive profound changes in the media, entertainment and technology landscape in 2006.

Already, old media are investing heavily in new-media ventures. Newspapers like this one are defending their bread-and-butter income - classified advertising - by stepping up their Web offerings. Media conglomerates such as News Corp. are buying Web properties like MySpace.com that connect them to young audiences, who are forsaking television and radio in favor of the Internet.

This year, new media could return the favor by investing in old media - the folks who know the most about producing entertainment content.

Here are some predictions for the media industry for 2006, based on interviews with industry analysts, executives and investors, along with a little intuition.

Cheap PCs, anyone?

Google will unveil its own low-price personal computer or other device that connects to the Internet.

Sources say Google has been in negotiations with Wal-Mart Stores Inc., among other retailers, to sell a Google PC. The machine would run an operating system created by Google, not Microsoft's Windows, which is one reason it would be so cheap - perhaps as little as a couple of hundred dollars.

Bear Stearns analysts speculated in a research report last month that consumers would soon see something called "Google Cubes" - a small hardware box that could allow users to move songs, videos and other digital files between their computers and TV sets.

Larry Page, Google's co-founder and president of products, will give a keynote address Friday at the Consumer Electronics Show in Las Vegas. Analysts suspect that Page will use the opportunity either to show off a Google computing device or announce a partnership with a big retailer to sell such a machine.

And that's not the only Google theory out there. Content producers wonder whether Google's push into video search will unravel the economics that make Hollywood hum. If viewers can find and legally download an episode of "Seinfeld" through Google, will that cut into cable and network television's profits?

And what if Google, after equipping cities, starting with San Francisco, with Wi-Fi wireless technology, starts to offer pay-TV service for free?

Still, to date, the company's $123-billion stock market value is based almost entirely on its dominance of one business: global text searches on the Web. Some investors worry that Page and co-founder Sergey Brin could be done in by their penchant for seeing themselves as do-gooders rather than profiteers. But those naysayers are in the minority. Most industry executives and Wall Street analysts believe that Google's search engine business is robust enough to give the young billionaires two or three years of wiggle room to build nifty services first and worry about making money on them later.

Microsoft comes out swinging

When Microsoft lost its yearlong battle to replace Google as the provider of advertisements on Time Warner Inc.'s AOL Search last month, one analyst described the defeat as "the death knell" for MSN, Microsoft's Internet service.

Within days, speculation was rampant that Microsoft, determined to keep itself in the game, had offered to buy Yahoo Inc. for $80 billion. If rumors were to be believed, the Microsoft bid - a premium of more than 30% over the Web giant's current market value - was rejected by Yahoo as too low.

Will Microsoft spend $90 billion or more to buy Yahoo or, alternatively, AOL parent Time Warner? Maybe not, especially when the software giant could buy Barry Diller's IAC/InterActiveCorp at a fraction of the price. If owned by Microsoft, Diller's collection of websites such as Ask Jeeves, Expedia, HSN.com, LendingTree and Ticketmaster could help drive traffic to MSN.

Icahn retreats

Wall Street sources said that upon learning of the Google-AOL alliance, bankers at Lazard Ltd. who represented financier Carl Icahn asked Gates to join their team.

The hope was that Microsoft would aid Icahn in his proxy battle to unseat the Time Warner board, split up the company and win control of AOL.

Most media experts, however, are betting that the opposite will occur: Icahn, lacking support from the entertainment giant's institutional investors, will fold his cards in defeat even before Time Warner's annual meeting this spring.

It seems like a long shot that Microsoft would throw its lot in with a likely loser. Still, by year's end, with its Windows operating system buffeted by a low-cost or free Google alternative, Microsoft may think twice about not having pursued a jewel like Time Warner.